Growing Herb Demand and Quality Concerns

Many of us in the TCM profession and industry here in the U.S. tend to think of herbs in a romantic way. We follow in the mythical footprints of Shen Nong, dwell on the beauty of the medicine, imagine the noble peasant farmer or herb gatherer. In reality, Chinese herbs are commodities, and traded in the billions of dollars. In 2016, the value of Chinese herbs traded totaled US$6.3 billion, of which US$2.3 billion was exported. China itself uses a staggering US$4 billion dollars’ worth of herbs each year.

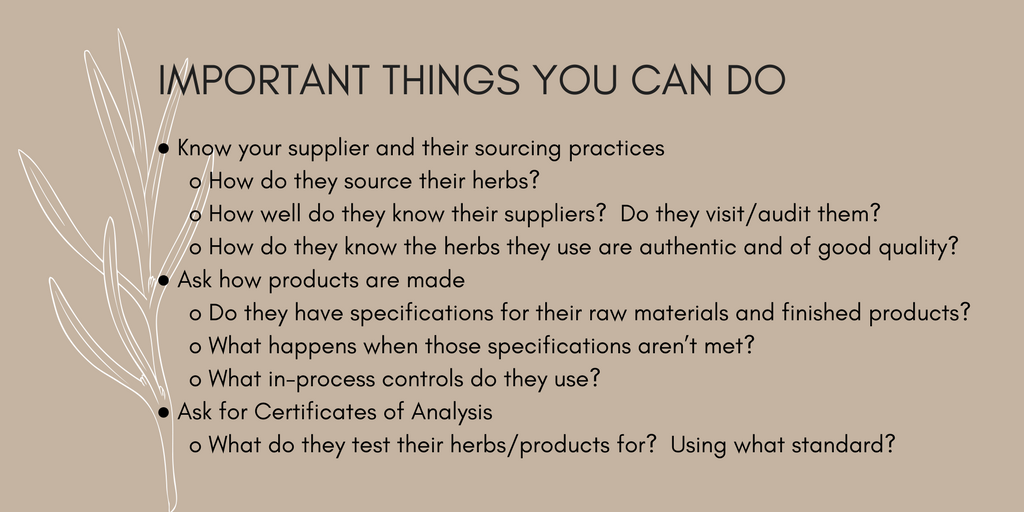

The commoditization of Chinese herbs has led to serious issues that significantly affect quality, efficacy, safety, sustainability, availability and price. By understanding these issues, practitioners can learn to better discern quality, ask the right questions, and make informed choices to achieve the best therapeutic outcomes.

Unsurprisingly, China is the world’s largest consumer of Chinese herbs. About 3 million tons are consumed annually in decoctions, extracts, pills, and tablets by about 1 billion people in China (currently China has 1.4 billion people, of whom 80% use TCM!).

Internationally, 1 million tons are consumed annually, with Hong Kong, Japan, and Korea being the largest importers. Europe and the U.S. are also major consumers of Chinese herbs, but almost exclusively as dietary supplement ingredients rather than as traditional Chinese medicine. It is estimated that over 90% of the herbs and extracts used in supplement manufacturing here in the U.S. comes from China.

With such staggering demand, the cultivation of herbs is of crucial importance, especially as many wild-crafted herbs have been threatened from unregulated overharvesting. While increased cultivation is good from availability and some price stability perspectives, unwelcome consequences have also become apparent:

- Less Dao di/geo-authentic herbs have come into the supply chain as growing areas of herbs expand.

- Wild habitats are quickly disappearing as land is taken over for cultivation.

- Monocropping increases pesticide use, resulting in more heavy metals and pesticide residues in plants and soil.

- Depletion of soil nutrients from lack of crop rotation or fallow periods leading to less hardy herbs which at least in some cases have been shown to have lower amounts of active ingredients.

- Immature plants are harvested to bring herbs to market sooner.Examples include the over stripping of Du zhong and Rou gui, with bark in the marketplace now being less than half as thick as they were 20 years ago.

- More sulfur dioxide fumigation and other preservatives are being used as herbs are being stored longer to drive up market price.

Unfortunately, apart from quality and environmental effects, high demand has also encouraged often blatantly unscrupulous practices that severely impact efficacy and safety:

- Wrong species—local herbs with similar names are being substituted without authentication. They are often completely different in function from the official Pharmacopoeia version, and may even be toxic.

- Food not medicine—food grade versus medicinal grade.The Chinese Pharmacopoeia specifies which genus and species are acceptable for a particular herb, and legally requires that only those species are allowed to be used as or in medicine. For example, medicinal Gou qi zi is only Lycium barbarum or L. chinense species, but with high demand and higher prices for medicinal grade herbs, Lycium dasystemum is often sold as Gou qi zi, which is technically only food grade.While fine to use in “Goji Berry” trail mixes, this would be illegal in China in say, Qi Ju Di Huang Wan. While not likely to be harmful, food grade herbs would not provide the same level of therapeutic quality we would expect in medicine.

- Scale Fraud—Tricks to increase weight. Examples abound of this: metal wires inserted in Dong chong xia cao, sand in the bellies of Hai ma. One of the most notorious cases happened in 2015, whereby an herb processor was found to have processed 5 tons (more than 10,000 pounds!) of Cang zhu by soaking in a solution of magnesium sulfate heptahydrate (Epsom salts to you and me). Only 1 ton was still in his possession when he was caught. Most of the other 4 tons had been dispensed at two local hospitals.

- Fakes—Examples include Dong chong xia cao made from dough, Fu ling made from rice powder, dried wild grapes dyed to look like Wu wei zi, painted wood posing as Chen Xiang, Dang gui slices pounded together with less expensive Du huo slices then sulfured to make them indistinguishable.

- “Reconditioned”— Due to the high demand for extracts, after an herb has been decocted and the extract processed and sold separately, the dregs are dried, dyed if needed, sulfured to brighten and then sold. Ginseng is a primary example whereby some “reconditioned” roots are mixed in with unprocessed roots and sold in bulk.

- “Enhanced”— Many sub quality, old or immature herbs are “enhanced” to make them appear fresher and higher quality. Examples include soaking Dang Shen in a brown sugar solution for sweeter taste and better color, polishing Tian Qi with charcoal dust, shellacking Ling zhi caps, dyeing Gou qi zi, Shan zha, and Hong hua; sulfuring Shan yao, Ju hua, Ge gen, Bai shao, and Dang gui to brighten, whiten, and hide imperfections.

- Commodity speculators—Due to government restrictions on property ownership, many investors began speculating on food and herb commodities, buying whole harvests then putting them into long term storage to drive up prices. It’s been estimated that thousands of tons of herbs are languishing in sub-standard, non-controlled warehouses. During storage, they are subjected to heavy sulfuring and pesticides to protect investments. Depending upon the age and condition of the herbs, they could then be subject to reconditioning and/or enhancements.

- Missing/substituted ingredients—Less scrupulous manufacturers have been found to have deliberately left out or substituted ingredients in processed products such as pills and tablets as the costs of herbs have risen rather than use correct ingredients and raise prices.

- Counterfeits—Not a new phenomenon, but higher demand for herbs has raised the costs for manufactured formulas, bumping up prices and making it even more attractive for “mountain bandit” factories (usually obsolete, not fit-for purpose factories) to make copies of popular brands and formulas. Counterfeiters use low quality herbs (in some cases, not even herbs) to make and sell counterfeits.

Unsurprisingly, these issues can also substantially impact price. These herbs are sold at herb markets in China, exported all over the world through wholesalers, brokers, or even over the internet (Alibaba sells plenty of Chinese herbs!). There have always been substantial price ranges based on size, origin, and grade, and price fluctuations due to seasonal availability, crop yield, and weather influences, but with the challenges mentioned makes it difficult to establish (and gauge) market price. However, the old adage of “you get what you pay for” is usually true. The price of food grade, wrong species, reconditioned, enhanced, counterfeit, etc. herbs tends to be (unsurprisingly) a bargain even though the prices of common herbs have on average tripled in the last 10 years, and some, like Sang piao xiao, almost 10 times higher.

It is important to note that all of the issues mentioned above can severely impact the downstream products made from them, whether pills, tablets, capsules, or extract powders. Quality issues can appear anywhere along the supply chain, and the longer the supply chain, the greater the potential for problems. As Chinese herbs make up a huge proportion of the herbal ingredients used in herbal products and dietary supplements around the world, these issues can challenge the quality of products regardless of where they are manufactured. The fact is that unless the buyer/importer/manufacturer is ethical, experienced, willing to test for specific quality parameters, and prepared to pay for quality, the quality of an herb or finished product will always be an uncertainty.

Being a family business with nearly 50 years of history, we have observed the changes in herb quality and both good and bad industry practices. This is why we have our own herb processing facility in China, and why we partnered with only a few trusted manufacturers and suppliers. We have worked quietly in the background for decades, with our herb masters traveling over 300 days of the year, and our testing of every batch of herb, extract, pill and tablet, to ensure that we are confident in the quality of our products and feel good about what we provide our customers. By sharing this behind-the-scenes industry information, we hope it helps everyone to make more informed decisions about suppliers and herbs.

Read more about Chinese herb supply and sustainability challenges.